3. Ask About Employer Matching

Many companies match their employees’ charitable contributions. Some even offer matches as high as 3:1, tripling the original gift amount. Talk to your human resources department about matching gifts.

You can ask other contacts to match your gifts, as well.

“If you are self-employed, consider asking a client or partner to match your gift,” Miller says. “Matching programs can turn your $100 donation into $300 or more.”

For assistance with matching gifts, reach out to the OSI at giving@osinst.org.

4. Leverage Tax Benefits

Charitable giving can be a win-win for you and the nonprofit when done strategically. Miller points out several charitable giving tax strategies that allow you to direct more money to causes that are dear to you rather than to Uncle Sam.

Talk with your tax professional about:

- Bundling donations. In this strategy, which is also called “bunching,” you will make a larger lump-sum donation to a nonprofit to reach the threshold you need to make itemized deductions on your tax return. For example, the standard deduction for married couples filing jointly is $29,200 for tax year 2024. Instead of giving $10,000 per year, a couple could give $29,200 every three years so they could itemize their taxes the years they make a large gift. “Many donors realize they are close to the threshold for household income and choose to make a larger gift to benefit both themselves and the nonprofit,” Miller says.

- Qualified charitable distributions. For donors aged 70½ or older, directing IRA distributions to a nonprofit can lower taxable income. “This is a very popular option for donors in the wealth distribution phase of their lives,” Miller notes.

- Gifts of appreciated stock. Donating appreciated stock that has been held for more than one year allows donors to avoid capital gains taxes, allowing you to give more without affecting your liquidity. “It is an impactful way to make a bigger gift without touching your checking account,” Miller explains.

5. Consult Your Wealth Adviser

For larger donations, working with a wealth adviser can unlock powerful giving tools. Options such as charitable gift annuities, paid-up life insurance policies, and planned estate giving can create lasting legacies while maximizing financial benefits.

“These vehicles allow you to make a meaningful gift while also achieving your financial and philanthropic goals,” Miller says.

6. Consider a Donor-Advised Fund

A donor-advised fund (DAF) works like a charitable investment account, enabling you to contribute assets, receive a one-time tax deduction, and recommend grants to your favorite charities over time.

“DAFs grow like an investment account,” Miller explains. “You can make your gift to the OSI directly from your fund. This is a great option for donors looking to maximize their philanthropic impact.”

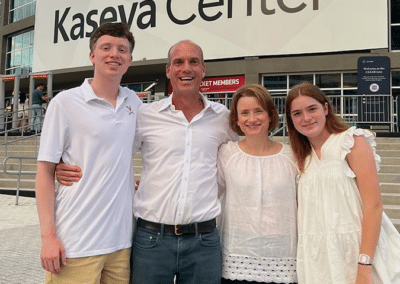

7. Establish a Named Fund

For those seeking to make a substantial, lasting impact, setting up a named fund — like the Shumadine family (pictured) did — is an excellent option and a great way to fund specific initiatives or to honor a loved one.

For example, Ingrid and David Hartz established the Miles of Hope Fund through OSI in 2022, a tribute to their son Miles, who later passed away from osteosarcoma. Since December 2024, the fund has raised more than $407,000 for osteosarcoma research. David credits friends, family, and the community with the fund’s success to date, inspiring others to rally around a shared cause.

“Named funds are a way to create a legacy that aligns with your values and passion,” Miller says. To create a named fund with the OSI, consider our Partnering for Progress program, which allows you to associate the name of a loved one with a specific osteosarcoma research study.